We all know it: product pricing is crucial in e-commerce. That’s why pricing is such a scary topic for many entrepreneurs to tackle. How you price your products can influence your cash flow, profit margins, sales volume, and even your branding.

Not to worry - in this article we’ll walk you through how to price a product, from the factors you should consider to types of pricing strategies.

Important Factors to Consider

First of all, take a look at key factors in two areas: the market and your business.

Do Market Research

Within your market, become familiar with your target customers, your competition, underlying market characteristics, and the latest trends.

Identifying what’s most important to your target customers - for example, price point, convenience, or quality - will help you to set your prices and put together a marketing strategy.

Understanding what’s already out there in terms of competition can give you a ballpark estimate of a typical pricing range.

Finally, trends such as increasing demand or the introduction of new technologies could impact where you set your prices.

Find Out Your Business’ Fixed & Variable Costs

Once you have a firm understanding of the market, do some reflection about your business.

Start with your costs. Write down everything you spend money on as a business. Your costs will generally fit into two categories: fixed costs and variable costs.

Fixed costs are the same no matter how many products you sell. Examples include rent, insurance, loan payments, and employee salaries.

Variable costs change with the amount of products you sell. They can include packaging, shipping, the value of your time, and the cost of goods sold (COGS).

COGS is how much you, the business, pay to acquire or make each product. If you buy it from someone else, the cost is straightforward; it’s what you paid for the product.

If you order raw materials and make it yourself, divide the cost of one order of raw materials by the number of products you can make from that order.

It’s essential to know these data points before putting together your pricing strategy, because if you don’t at least cover your costs, your business will fail!

Consider Price Elasticity

Next, think about your product and the concept of elasticity to understand how changing your prices could affect your immediate sales volume.

If the demand for your product is elastic, it means people will stop buying it or switch to a competitor if you raise your price too much. Chocolate bars or cable TV are both examples of elastic products.

On the other hand, you can raise the price on an inelastic product such as cigarettes or salt and many people will still continue buying it.

Luxury goods are often elastic products while basic necessities are frequently inelastic.

If you sell a luxury or optional product, be careful about raising prices and monitor the price points of your competitors closely.

Set Your Volume & Branding Goals

Finally, decide on your business goals. Where do you want to be in terms of revenue, profit, and desired sales volume?

Would you rather have low prices and high sales volume or high prices and low sales volume? Both are viable ways to make a successful online store, but the business journey will differ.

Second, how do you want your brand to be perceived? Pricing must go hand-in-hand with your store’s branding strategy and desired positioning in the minds of consumers.

If you sell at low prices, you will position your store as a place for buying cheap products and vice versa.

There’s a balance to achieve in both volume and branding. Katharine Paine, founder of media research company The Delahaye Group, sums it up well:

“The moment you make a mistake in pricing, you’re eating into your reputation or your profits.”

There are many factors to consider when planning pricing strategy, but once you have these reference points, you’ll be prepared to take your pricing plan to the next level.

Basic Pricing Strategies

Now that you know about the market, your business’ costs, and your goals, you’re ready to form your pricing plan.

Read on to learn more about the two of the simplest pricing strategies: Markup Pricing and Manufacturer’s Suggested Retail Price (MSRP).

Or - if you’re already a pricing pro - skip down to the next section to learn about more advanced pricing strategies.

Markup Pricing

Also known as Cost-Plus Pricing, this strategy involves taking the amount a product costs you, the business, then adding on top the amount of profit you want, expressed as a dollar amount or percentage of the final selling price.

For example, if your product costs you $100 and you want to make $66 for every sale, your final selling price would be $166. That’s a 40% gross profit margin because 40% of $166 is $66.

What if you only know the gross profit margin you want as a percentage?

With the same example - $100 cost to you and 40% gross profit margin - use the formula below:

- Gross Profit Margin Formula

- Final Selling Price = Total Variable Costs / (1 - gross profit margin as a decimal)

- Final Selling Price = 100 / (1 - 0.4)

- Final Selling Price = $166

Now you know that you should add $66 to the $100 cost to you to get a gross profit margin of 40%.

Careful! The terms “gross profit margin” and “markup” are not the same thing!

While gross profit margin is the percentage of the selling price, markup is the percentage of the cost to you.

While the gross profit margin for the example above is 40%, the markup is 66% because $66 is 66% of $100.

Let’s say you know the markup percentage you want to use, but not the dollar amount. Use this formula:

Markup Formula Final Selling Price = Total Variable Costs x (1+markup percentage as a decimal) Final Selling Price = 100 x (1+0.66) Final Selling Price = $166

So, how do you know what is an appropriate gross profit margin or markup to use?

There are no easy answers here, as it depends on your business and industry.

One popular markup method - called Keystone Pricing - is to simply double the cost of the product - a 100% markup or 50% gross profit margin.

However, that may not be the best option for your business.

Once again, take a look at your market and your business costs to determine the right profit margin and markups for you.

Manufacturer’s Suggested Retail Price (MSRP)

The second basic pricing strategy is to use the Manufacturer’s Suggested Retail Price, if available for your product.

MSRP is the retail selling price a provider suggests to retailers.

It’s a way to make prices the same in every store. In some cases, stores are obligated to sell their products with the MSRP, but this practice is becoming less and less common.

More Types of Pricing Strategies

Beyond basic strategies, there’s so much more you can do with pricing! Take a look at the options below.

Going Low

Competitive Pricing

Just as the name suggests, competitive pricing involves examining the prices of your competitors, then pricing your products just below them.

This is especially effective if your product is elastic, competition is fierce, and clients can change stores easily following better deals.

It’s very important to constantly monitor market prices for this to work, while at the same time verifying that your profit margins are within an acceptable range.

Penetration Pricing

In this strategy, a business enters a market with low prices in comparison to the competitors or the usual cost of the products.

With its low prices, the new business attracts a following of customers.

Then, once the business has established name recognition and a loyal customer following, it slowly raises its prices over time.

Freemium Pricing

With freemium pricing, a business offers part of their product or service for free and upgraded or expanded version for a price.

This strategy is common among software as a service (SaaS) businesses.

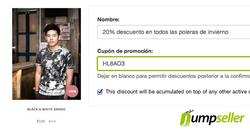

Discount Pricing

More common for established businesses, offering discounts is a great way to attract more customers. A few examples include:

-

Multiple Pricing

When a business offers several products for one price, in a bundle, often for a lesser dollar amount than if the customer bought each of the products individually.

This gives the impression of a good value to the customer, while simultaneously incentivizing them to spend a larger amount.

-

Loss-leading pricing

Offering one product for a discount, then encouraging customers to buy other products while they are at it.

This works well in physical stores, as customers go in for the discounted item, but find themselves also buying additional items that catch their attention.

-

Anchor pricing

Displaying the original price with a line through it, then showing the discount price.

For example: Was $42.99, Now $19.99! Showing the price difference drives home the point that customers are getting a good deal.

Going High

Premium Pricing

Some businesses place their price point higher on purpose, to position themselves as an exclusive, high-quality brand and set themselves apart from the competition.

The best businesses who use premium pricing focus their marketing efforts on customers with high purchasing power, communicating luxury and excellent service.

For this to work, you must have products are just as high of quality as your price suggests while at the same time offering a purchasing experience that surpasses the customer’s expectations.

Psychological Pricing

Psychology is applicable to many pricing strategies, especially Discount Pricing.

At the same time, one of the most popular psychological pricing strategies is also the simplest: set the last digit of your price as an odd number such as 9.

Studies show that shoppers prefer prices ending in 9, especially for new items.

Under this strategy, the same product priced at $54 and $59 could see higher sales at $59!

Careful though - it’s best to use this type of pricing strategically.

If you use prices ending in 9 for all of your products, all the time, the strategy could be less effective, and you could make your brand seem cheap.

Skimming Strategy

The opposite of Penetration Pricing, this strategy involves entering a market with a high price, then slowly lowering it over time.

This is common for technology vendors, as products lose value and popularity when new, improved models come out.

Conclusion

Both the benefit and the challenge of pricing is that it’s different for every business. There isn’t just one model that works for everyone.

With solid data backing you up and well-thought-out pricing strategies, you’ll be able to beat out the competition and propel your business to even higher profits.